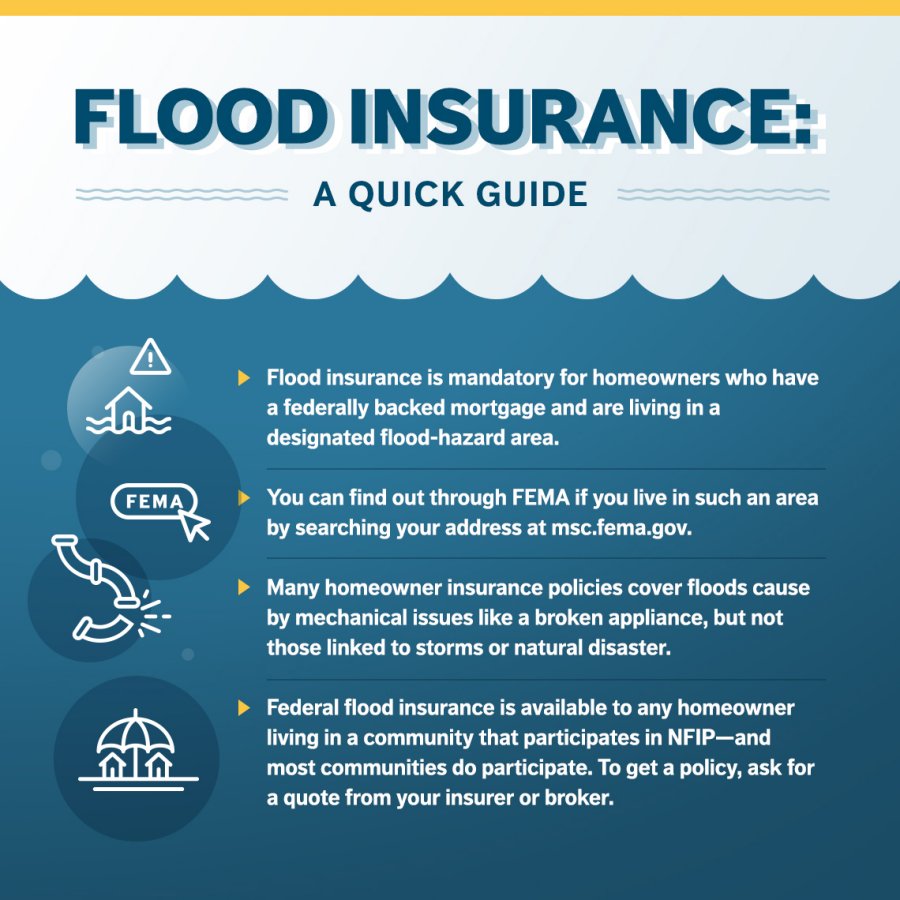

Is My Flooding Damages Covered? Do not leave your home unguarded-- get your flooding insurance coverage quote now right here and guarantee you have the coverage you require before the following tornado hits. Both building and components protection are crucial for making certain that your home and possessions are secured in case of a flooding. Explore flood insurance policy protection options below to get more information about how to shield your home. Flooding insurance policy covers overflow of inland or tidal waters and uncommon and fast build-up or runoff of surface area waters from any type of source. Nevertheless, the flooding needs to be a basic and short-term problem of partial or full inundation of 2 or even more acres of normally dry land area or of two or more properties (a minimum of among which is your own). Although flooding insurance coverage especially leaves out wind and hail storm damages, many home owners insurance coverage gives this coverage. Yes, if you live in a neighborhood that joins the NFIP, you can purchase flood insurance to cover the contents of your home or business. But this settlement does not influence the information we publish, or the reviews that you see on this site. We do not include deep space of business or financial deals that might be available to you. You ought to take immediate activity to shield your residential property and avoid mold and mildew development that could cause additional damage. If your hot water heater bursts but the damages is linked to poor upkeep, your insurance case might be rejected.

Why would certainly insurance policy refute a water damage claim?

Insurance claims are often rejected due to lack of upkeep, failing to minimize damages, insufficient paperwork, or plan exemptions like mold, sump pump failing, or vacancy.

Does A Deductible Relate To My Coverage?

A basic condition of flood likewise exists if two residential properties are affected, one of which is your own. Flooding insurance coverage covers your home's structure elements and tools that's required to support the framework (heating system, water heaters, circuit breakers, etc). Watercrafts might be covered by a different recommendation to a homeowner's policy or by a separate watercraft proprietor's plan. If the water problems various other items in the utility room, like a dryer or cupboards, your personal property coverage ought to cover the losses. It depends on what caused the mold and mildew and the policy protection you have. Mold and mildews need water or dampness to grow, yet not all causes of water damages are covered by homeowners insurance coverage. That being stated, the majority of house owners insurance coverage have exclusions in position for various other common reasons for mold and mildew. If you have many important belongings, you can think about buying extra personal property protection to guarantee you are effectively shielded. Also, a set up personal effects rider can be a terrific method of insuring details things versus loss. Home owners' insurance plan assist safeguard your home and your wallet from unexpected damage, and one of the characteristics of these plans is the defense they provide against storms. If your home is harmed, your plan can assist you cover the expense of fixings, however not all types of damages are covered by your plan. Though a Michigan property insurance coverage declares lawyer can help you appeal a choice if your claim is refuted, it's useful to comprehend the usual kinds of tornado damages most policies cover. To cover flooding damage, you'll need a separate flooding insurance coverage. For lots of Florida property owners, the actual surprise after a storm isn't the damages-- it's learning that their insurance will not cover it. Flooding is just one of the most typical (and expensive) calamities in the state, yet it's not included in a conventional home owners insurance coverage.Does Not My Property Owners Insurance Coverage Cover Flooding?

- Flooding insurance policy covers overflow of inland or tidal waters and uncommon and rapid build-up or runoff of surface area waters from any resource.Have your plan number helpful and be prepared to answer inquiries concerning the level and severity of the water damages.An insurance coverage breach of contract legal representative can assist you test your insurance carrier if you believe the insurance adjuster is incorrectly denying your case or declining to pay you rather for your protected damages.Poor water drainage systems, rapid buildup of rainfall, snowmelt and damaged water pipe can all lead to flooding.